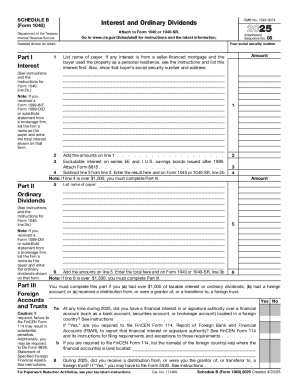

IRS 1040 - Schedule B 2018 free printable template

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

About IRS 1040 - Schedule B 2018 previous version

What is IRS 1040 - Schedule B?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule B

What should I do if I need to correct information on my IRS 1040 - Schedule B after filing?

If you discover errors on your filed IRS 1040 - Schedule B, you need to file an amended return using Form 1040-X. Be sure to include the correct Schedule B with the amended return. It’s crucial to do this as soon as you notice the mistake to avoid potential penalties.

How can I verify if my IRS 1040 - Schedule B has been processed?

You can track the status of your IRS 1040 - Schedule B through the IRS 'Where's My Refund?' tool if you filed electronically. If you mailed your return, expect a longer processing time. Checking for e-file rejection codes helps identify issues that may delay processing.

What are common errors people make when filing IRS 1040 - Schedule B and how can I avoid them?

Common errors include mismatching income amounts and failure to report all required income types. To avoid these mistakes, double-check your entries against your financial documents and use tax preparation software that can flag potential issues for you.

What technical requirements should I meet for e-filing my IRS 1040 - Schedule B?

To e-file your IRS 1040 - Schedule B, ensure your software is compatible with the IRS e-file system. Check that you have a stable internet connection, and be aware of browser compatibility to avoid technical issues during submission.

See what our users say